Salary Calculator Tax Australia

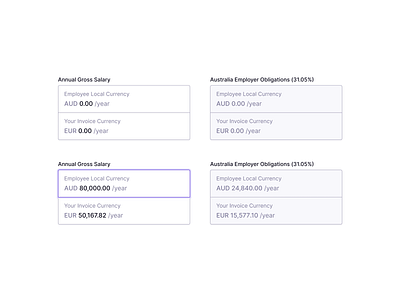

It can be used for the 201314 to 202021 income years. Each calculator provides the same analysis of pay but is simplified to allow you to enter your Australia salary based on how you are used to being paid hourly daily etc.

Australia 125000 Salary After Tax Australia Tax Calcu

See how much youll be paid weekly fortnightly or monthly with our easy to use pay calculator.

Salary calculator tax australia. Is Your Salary Protected. This Australian Tax Calculator will show you what your weekly fortnightly monthly Income or Net Salary will be taking into account current ATO tax rates. Insurance quotes on-screen is a rarety in Australia.

If you are a. This Calculator will display. The ATO publish tables and formulas to calculate weekly fortnightly and monthly PAYG income tax instalments that can vary from the annual tax amounts.

Differences will always be favour of the ATO however these will be refunded when the annual year tax return is processed. Why this PAYG Calculator. Before you use the calculator.

What your take home salary will be when tax and the Medicare levy are removed. Your salary is 60000 per year. Select a specific Australia tax calculator from the list below to calculate your annual gross salary and net take home pay after deductions.

This Australian Salary Calculator will show you what your weekly fortnightly monthly Income or Net Salary will be after PAYG tax deductions. Simply enter your annual or monthly income into the tax calculator above to find out how Australian taxes affect your income. 41453 is yours to keep.

It makes sense to protect it. Simply enter your Gross Income and select earning period. Each pay calculator includes personal tax allowances calculates your pension and medical.

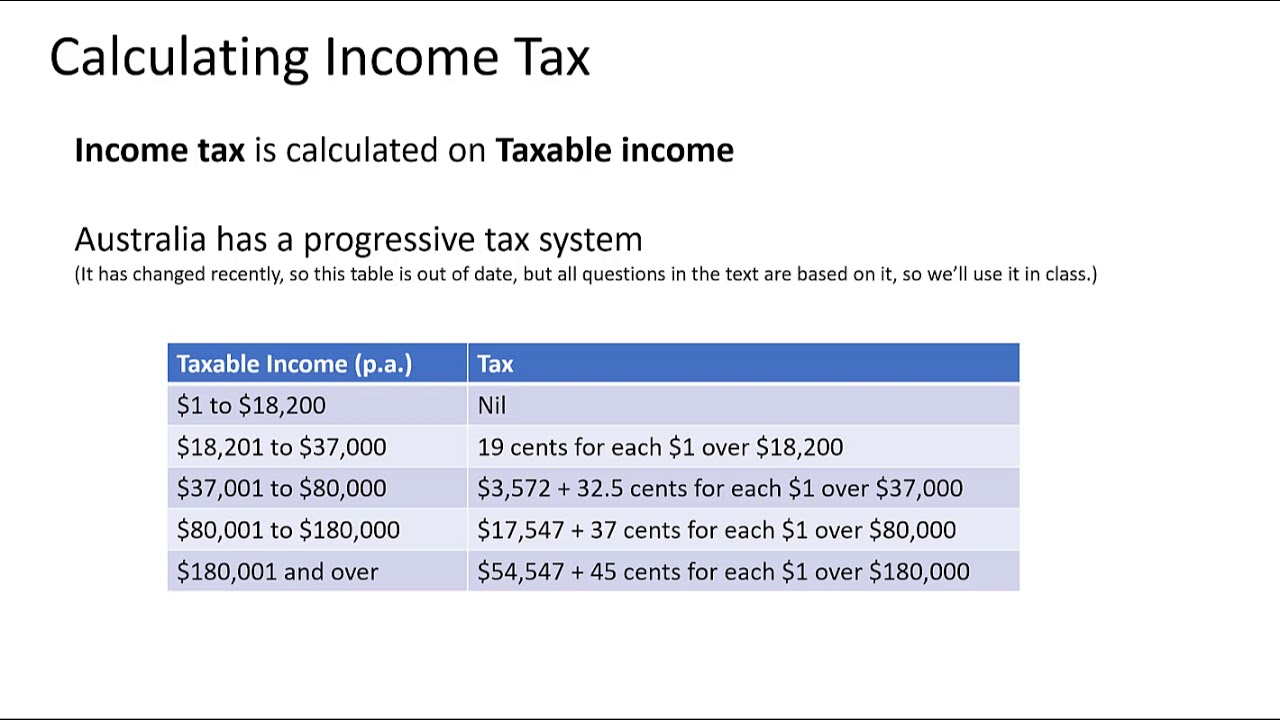

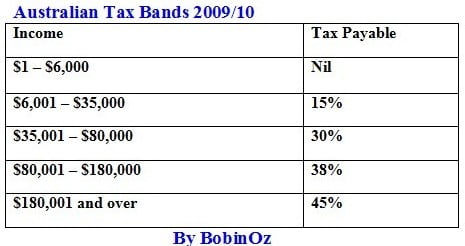

That means you pay a total of 7797 in income tax 1000 in Medicare Levy and get 250 in tax offset. Information you need for this calculator. Australias progressive tax system means that if you earn more youll usually need to pay more in tax.

The tax you need to pay depends on your taxable income and other factors that impact tax payable such as. The reason is to make tax calculations simpler to apply but it can lead to discrepancies. In this instance a salary calculator can help you calculate the amount of tax you will be paying based on your annual salary versus the actual amount you will be required to pay at the end of the year.

If you have HELPHECS debt you. The projected total amount of. If you are repaying HELPHECS debt click the relevant box to say Yes.

The Tax Calculator will also calculate what your Employers Superannuation Contribution will be. Do you earn the same. If you make 50000 in taxable income in Australia then first 18200 is not taxed next 18800 is taxed at 19 and the rest 13000 is taxed at 325.

For more information see assumptions and further information. How much do you earn. If your salary includes Superannuation click the relevant box to say Yes.

Enter your salary into the Annual Salary field. The lowest bracket is 0 known as the tax-free rate for individuals on low incomes. This calculator helps you to calculate the tax you owe on your taxable income for the full income year.

Which tax rates apply. Australian Tax Calculator 2020. Your income is your biggest asset.

This calculator can also be used as an Australian tax return calculator. Income tax on your Gross earnings Medicare Levyonly if you are using medicare Superannuation paid by your employer standard rate is 95 of your gross earnings. Income taxes in Australia are calculated based on your total taxable income and the relevant tax rate that applies to you based on factors such as your residency status.

The Salary Calculator will also calculate what your Employers Superannuation Contribution will be. Finally Your Take Home Pay after deducting Income Tax and Medicare. What this calculator doesnt cover.

Salary survey results for most popular occupations from all states in Australia. Tax rates increase progressively up to 45 for incomes over 180000. Your marginal tax rate.

You can check any option if it applies to you. How much Australian income tax you should be paying. Learn your salary taxes and superannuation contributions.

Especially if you dont want to provide your contact details to see the. To use the Australian tax calculator.

Payroll Tax The Hidden Risks Of Interstate Employees Hlb Mann Judd

Ato Tax Calculator Atotaxrates Info

Calculating Income Tax Payable Youtube

Australia Tax Calculator 2021 22 Salary Calculator

Tax Calculator Designs Themes Templates And Downloadable Graphic Elements On Dribbble

How To Calculate Income Tax In Excel

Prelim Standard Math Calculating Tax Art Of Smart

Income Tax Cuts Calculator Australia Federal Budget 2020 21

Tax Time Will You Pay Tax On A Government Payment National Seniors Australia

Income Tax Australian Tax Brackets And Rates 2020 21

Payroll Tax Deductions Business Queensland

How Do You Get From Net Income For Tax Purposes To Taxable Income To Tax Payable Intermediate Canadian Tax

Cost Of Living Australia Income Tax Rates By Bobinoz

How To Calculate The Tax In Australia Quora

How To Create An Income Tax Calculator In Excel Youtube

Au Income Tax Calculator July 2021 Incomeaftertax Com

Save Thousands Of Dollars In Taxes With A Student Visa Go Study Australia

Payroll Tax Deductions Business Queensland

Post a Comment for "Salary Calculator Tax Australia"