Wage Calculator Chicago

The law defines Overtime as any compensation earnings based on an hourly salary above what the worker routinely earns per week and any extra hourly pay above the regular hourly wage. Child Care Eligibility Calculator.

The average salary in Chicago IL is 72k.

Wage calculator chicago. Compare the Cost of Living in Chicago Illinois against another US Cities and States. Illinois Hourly Paycheck Calculator. Trends in wages increased by 05 percent in Q1 2021.

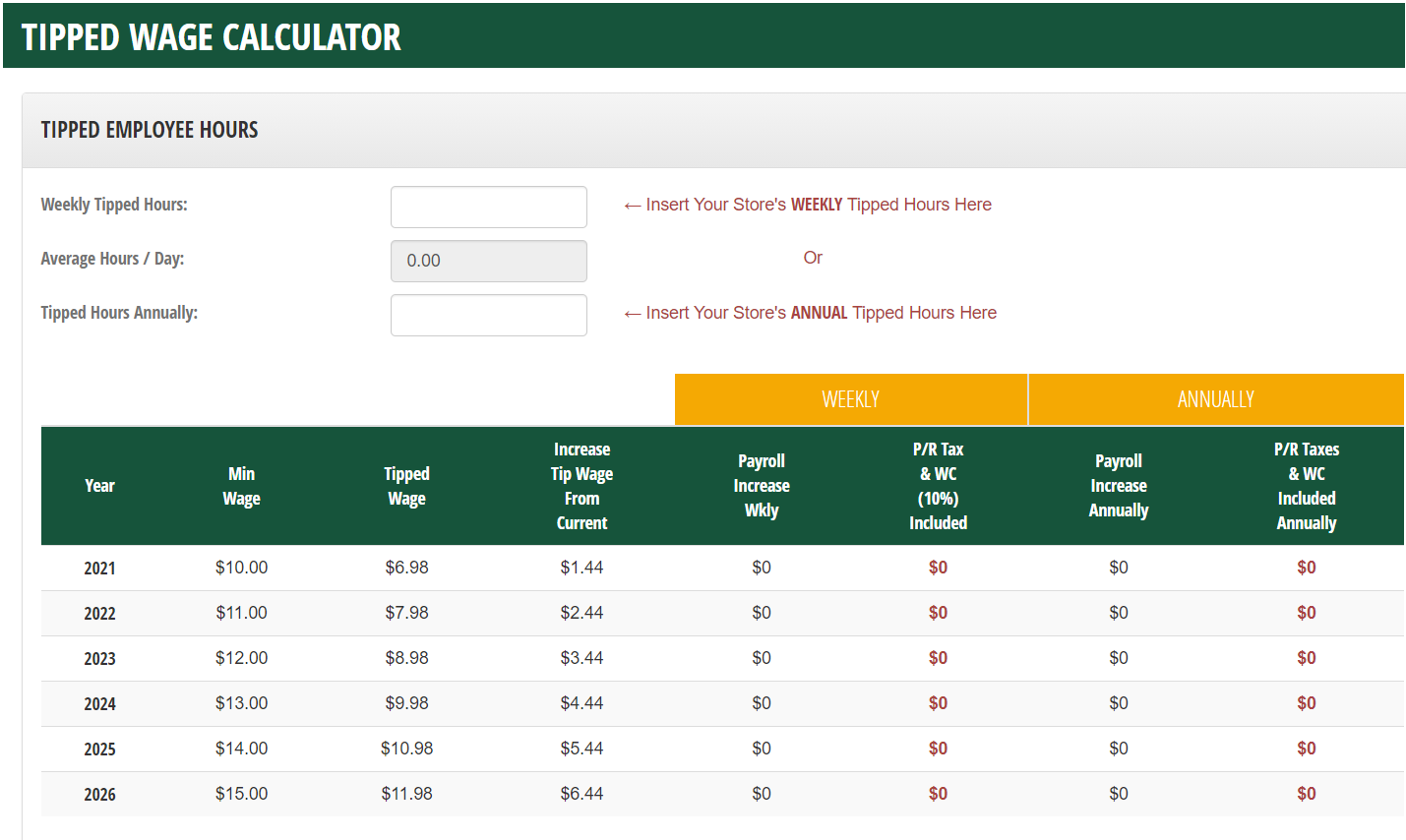

See what youll need to earn to keep your current standard of living wherever you choose to work and live. Tipped workers workers who receive tips as part of their wage like restaurant servers have a minimum wage of 840 for employers with 4 to 20 workers and 900. The cost of living in Chicago IL is.

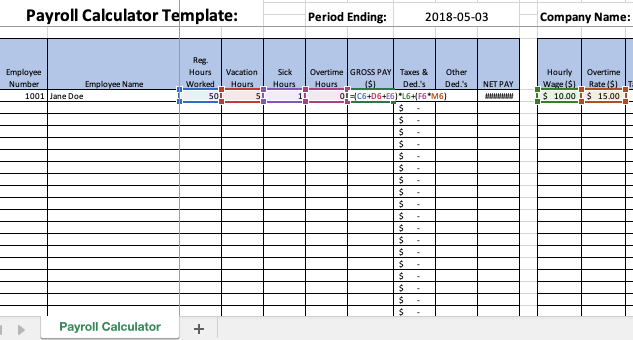

See how this. Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be calculated as. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time.

This dataset lists all current City of Chicago employees complete with full names departments positions and annual salaries. For periods 1 to 4 you will need to calculate the amount of your 10 Temporary Wage Subsidy a separate program that applies to this CEWS claim period before you enter it at Line F. We make it easy for you to understand the minimum wage in any given state.

Salaries range from 27700 USD lowest average to 489000 USD highest average actual maximum salary is higher. Monthly income from Social Security or Other Sources. It is not a substitute for the advice of an accountant or other tax professional.

Calculating the Average Weekly Wage and Compensation Rate. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck calculator. The living wage shown is the hourly rate.

The federal minimum wage is 725 per hour and the Illinois state minimum wage is 1100 per hour. FLC Prevailing Wage Level Calculator. Making use of our United States Minimum Wage Calculator.

The final column lists the approximate annual salary with furlough dayssalary reductions. The city estimates more than 400000 people will get a raise because of the increase. Monthly TANF Cash Assistance Amount.

23 lignes Living Wage Calculation for Cook County Illinois. Total Family Size. Monthly Child Support Received.

This is the average yearly salary including housing transport and other benefits. A person working in Chicago typically earns around 110000 USD per year. This Illinois hourly paycheck calculator is perfect for those.

There are legal minimum wages set by the federal government and the state government of Illinois. The state of Illinois compensation rate is two-thirds 66 23 of the employees average weekly wage. Use our calculator to discover the Illinois Minimum Wage.

The Illinois Minimum Wage is the lowermost hourly rate that any employee in Illinois can expect by law. The law states that whichever is the higher applies. As of July 1 2021 the minimum wage in Chicago is 1500 per hour for employers with 21 or more workers and 1400 per hour for employers with 4 to 20 workers.

Chicagos minimum wage is now at 15 per hour four years before the state is set to reach that bench mark. Line F 10 Temporary Wage Subsidy for Employers reduction. Salaries vary drastically between different careers.

23 lignes Living Wage Calculation for Chicago-Naperville-Elgin IL. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. About Chicago IL.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. For claim periods 5 and later the amount for this line will be 0. Double check the information that you have entered and then press Calculate to see the minimum wage in your state.

For H-1B H-1B1 E-3 and H-2B Visas and PERM Labor Certification. Number of Children Attending Child Care. For hourly employees the annual salary is estimated.

Monthly Gross Employment Income. ZenPayroll Inc dba Gusto Gusto does not warrant promise or guarantee that the information in the Paycheck Calculator. Use our calculator Choose the state from the drop-down list You can also enter your hours worked per week if you wish optional.

Please select your county Select one of the following. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Illinois residents only. 30 8 260 62400.

Overview of Illinois Taxes Illinois has a flat income tax of 495 which means everyones income in Illinois is. The living wage shown is the.

Florida Restaurant Lodging Association Reveals Drastic Wage Hike From Ballot Amendment 2 With Launch Of New Tipped Wage Calculator Frla

Illinois Paycheck Calculator Smartasset

Mit S Living Wage Calculator Is Actually Pretty Accurate Personalfinance

Excel Payroll Formulas Includes Free Excel Payroll Template

Universal Living Wage Wage Calculator

Http Www Voices4kids Org Wp Content Uploads 2014 08 Raising Min Wage Helps 1 In 5 Il Kids Final Pdf

Salary To Hourly Salary Converter Salary Finance Hour

How To Calculate Process Retroactive Pay

Illinois Paycheck Calculator Smartasset

New Tax Law Take Home Pay Calculator For 75 000 Salary

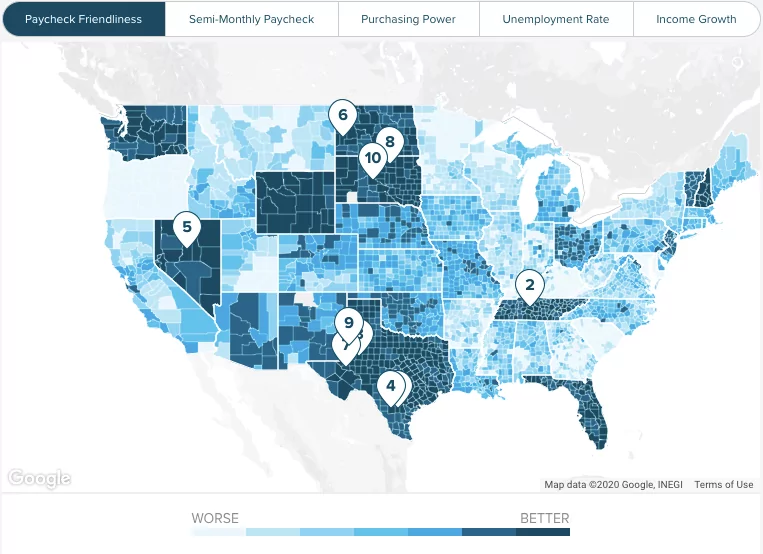

Pin On Visualizations Lean Forward

Average Weekly Wage Chicago Workers Comp Lawyer

Workers Compensation Perspectives Are Wages Or Salary Fully Covered By Workers Compensation Insurance

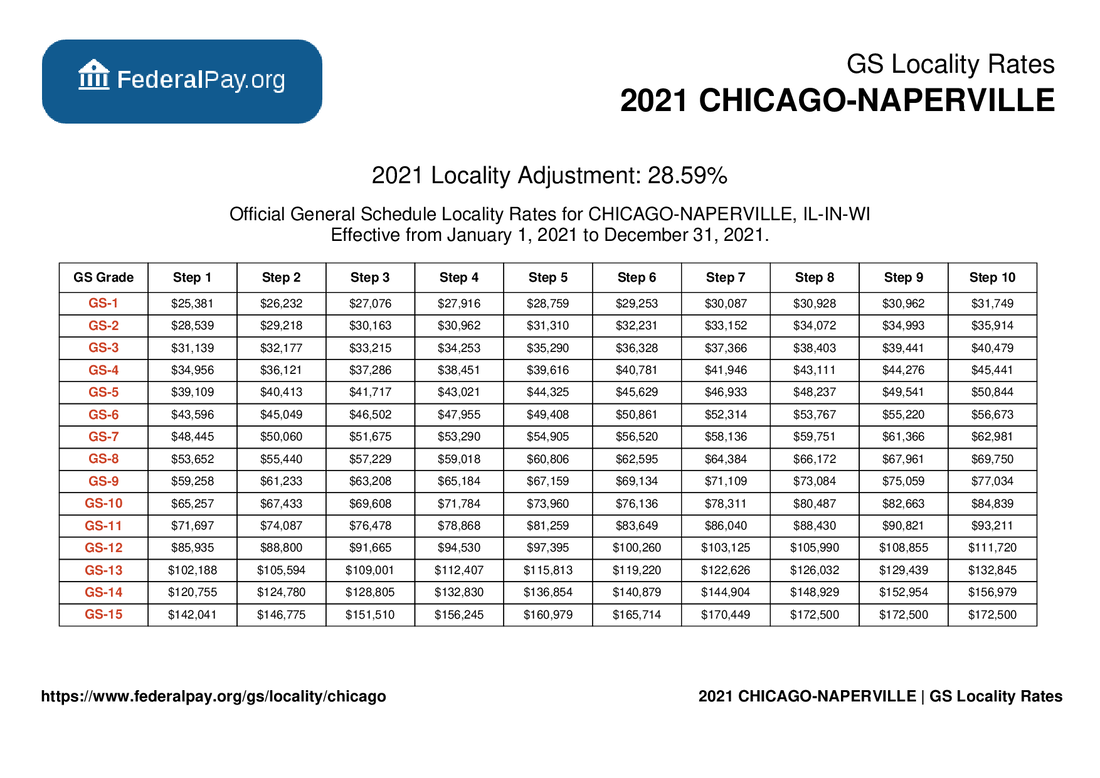

Chicago Pay Locality General Schedule Pay Areas

Top 6 Best Online Payroll Calculators 2017 Ranking Top Free Payroll Tax Calculators Estimators Advisoryhq

Unemployment Calculator See How Wages Stack Up Against The Covid 19 Crisis Unemployment Benefits Abc7 Chicago

Post a Comment for "Wage Calculator Chicago"