Salary Calculator Ato

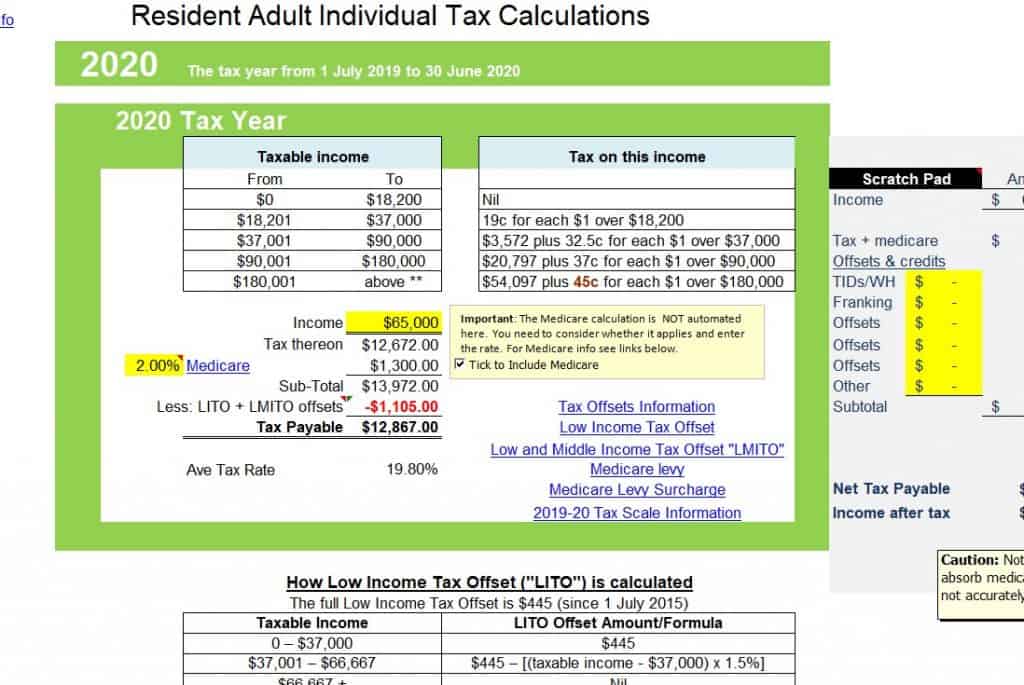

Finally Your Take Home Pay after deducting Income Tax and Medicare. The reason is to make tax calculations simpler to apply but it can lead to discrepancies.

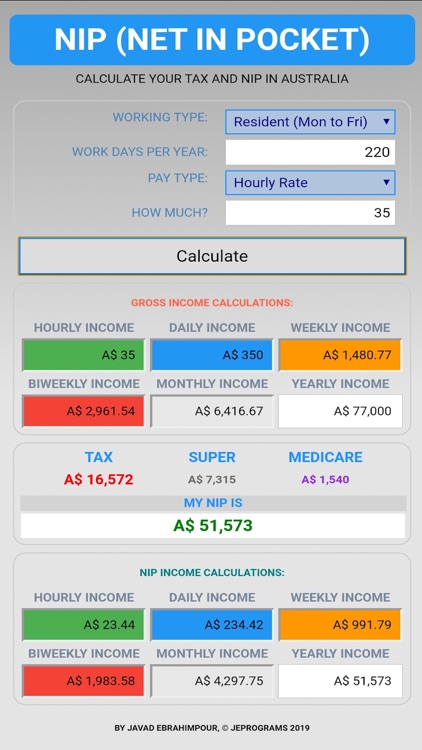

Its simplicity reflects the streamlined wage system in Australia and takes into account current tax rates including whether youre a resident or a visitor and the Medicare Levy as well as providing an estimate of the minimum superannuation pension payment from an employer.

Salary calculator ato. This calculator can help you estimate just how much you could earn from the time you start working until the time you retire. This pay calculator uses official ATO tax rates to calculate your pay after taxes. The Tax Calculator will also calculate what your Employers Superannuation Contribution will be.

Enter the number of hours and the rate at which. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Please enter your salary into the Annual Salary field and click Calculate.

Your employer may use ATO tax tables to calculate your taxes and thus you might be getting different amount. The ATOs tax withheld calculator applies to payments made in the 202122 income year. Why not find your dream salary too.

It can be used for the 201314 to 202021 income years. Which tax rates apply. An indicative average salary packaging administration fee of 22000 has been included.

You may not be eligible to package all items included in the calculator. It can be used for the 201314 to 202021 income years. The number may just surprise you.

The Industry Super group more about them later recently added a simple reliable salary calculator to their website. If you are using the Pay Calculator as a Salary Calculator simply enter your annual salary and select the relevant options to your income. This Australian Tax Calculator will show you what your weekly fortnightly monthly Income or Net Salary will be taking into account current ATO tax rates.

Income tax on your Gross earnings Medicare Levy only if you are using medicare Superannuation paid by your employer standard rate is 95 of your gross earnings. For salary or wage payments you need to pay the minimum superannuation guarantee SG contribution based on the super guarantee rate for the relevant year. Enter your annual salary and age and see how much you will earn in a lifetime.

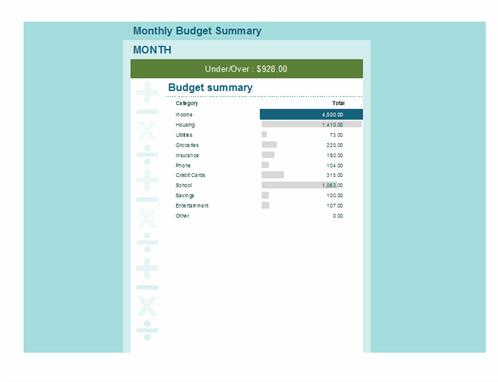

To use the tax calculator enter your annual salary or the one you would like in the salary box above. This calculator helps you to calculate the tax you owe on your taxable income for the full income year. This calculator will give you an estimate of your gross pay based on your net pay for a particular pay period weekly fortnightly or monthly.

This calculator will help you work out the Fringe benefits tax FBT for public benevolent institutions PBIs health promotion charities HPCs rebatable employers public and not-for-profit hospitals and public ambulance services. Superannuation guarantee contributions calculator. You can then see how your salary is broken down.

If you employ working holiday makers other tax tables apply. If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month. The Salary Calculator will also calculate what your Employers Superannuation Contribution will be.

An important thing to note is that certain ATO tax tables round your income and taxes to the nearest dollar as per the tax tables provided by the Australian Tax Office and hence there may be some slight discrepancies with your actual payslip. The latest budget information from April 2021 is used to show you exactly what you need to know. ATO tax withheld calculators.

Differences will always be favour of the ATO however these will be refunded when the annual year tax return is processed. If you have HELPHECS debt you can calculate debt repayments. The ATO publish tables and formulas to calculate weekly fortnightly and monthly PAYG income tax instalments that can vary from the annual tax amounts.

Information you need for this calculator. The Super guarantee SG contributions calculator tool helps you work out the superannuation guarantee amount to pay to your employees super fund. The items you could package are determined by your employers salary packaging policy and the industry sector you work in.

Use this calculator to quickly estimate how much tax you will need to pay on your income. In most cases your salary will be provided by your employer on an annual basis. This calculator is always up to date and conforms.

This Calculator will display. This Australian Salary Calculator will show you what your weekly fortnightly monthly Income or Net Salary will be after PAYG tax deductions. For more information refer to Tax table for working holiday makers.

For information about other changes for the 202122 income year refer to Tax tables. The Tax Calculator uses exact ATO formulas when calculating your salary after income tax. Before you use the calculator.

And you can figure out are you eligible for and how much of Low. Find out the benefit of that overtime. Hourly rates weekly pay and bonuses are also catered for.

Usually you pay more tax this way and thats why you get tax refund from the ATO. How to use the Take-Home Calculator. Please contact Maxxia or refer to your employers salary packaging policy for more information.

This simplified ATO Tax Calculator will calculate your annual monthly fortnightly and weekly salary after PAYG tax deductions.

Ato Tax Calculator 2021 2022 Tax Rates

The Business Spreadsheet Template For Self Employed Accounting Amp Taxes Amp Llcs Business Spreadsheet Business Spreadsheet Templates Spreadsheet Template

Tax Calculator Archives Stg Fire Safety Training

Tax Calculation Spreadsheet Spreadsheet Business Tax Excel Spreadsheets

The Ato Salary Packaging Figures Breakdown Easisalary Australia

Nip Income And Tax Calculator By Javad Ebrahimpour

What Is Annual Income How To Calculate Your Salary Salary Calculator Income Tax Return Income

Made My Sister A Nursing School Survival Kit Each Item Comes With A Note Calculator Medical School Survival Kit School Survival Nursing School Survival Kit

Ato Tax Calculator 2019 By Pocketbook

Australian Tax Calculator Excel Spreadsheet 2018 To 2025 Atotaxrates Info

Australian Salary Calculator Apps On Google Play

How To Calculate Tax On Fortnightly Pay

Ato Tax Calculator Atotaxrates Info

How To Calculate Tax On Fortnightly Pay

Hire Payroll Service Provider High Skilled Payroll Service Provider Usa Hcllp Payroll Payroll Software Accounting Services

Gdr Robotron Calculator In Box East Germany Konkret 100 Design Etsy Red Led Plastic Case Calculator Words

Save Thousands Of Dollars In Taxes With A Student Visa Go Study Australia

Post a Comment for "Salary Calculator Ato"